The Greatest Guide To Top 30 Forex Brokers

Rumored Buzz on Top 30 Forex Brokers

Table of ContentsThe Of Top 30 Forex BrokersTop 30 Forex Brokers Can Be Fun For AnyoneHow Top 30 Forex Brokers can Save You Time, Stress, and Money.The Definitive Guide for Top 30 Forex Brokers6 Simple Techniques For Top 30 Forex BrokersTop 30 Forex Brokers Fundamentals ExplainedTop Guidelines Of Top 30 Forex Brokers

However, forex trading has its negative aspects, such as high risk and volatility. Foreign exchange is the biggest and most liquid market in the globe. Trillions of bucks worth are traded everyday. A job as a forex trader can be lucrative, adaptable, and highly engaging. There is a steep understanding curve and forex traders encounter high risks, leverage, and volatility.

They consist of: Forex trading can have very low prices (brokerage firm and payments). There are no commissions in a real sensemost forex brokers make earnings from the spreads in between forex money.

Top 30 Forex Brokers Things To Know Before You Buy

The foreign exchange markets run throughout the day, allowing trades at one's ease, which is extremely helpful to short-term investors that tend to take settings over short durations (claim a few minutes to a few hours). Few investors make professions throughout complete off-hours. For instance, Australia's daytime is the nighttime for the East Shore of the united state

business hours, as little growth is expected and prices remain in a steady variety during such off-hours for AUD. Such traders adopt high-volume, low-profit trading techniques, as they have little profit margins as a result of a lack of advancements particular to forex markets. Rather, they attempt to make profits on reasonably secure low volatility duration and compensate with high quantity professions.

Foreign exchange trading is extremely accommodating in this way. Contrasted with any kind of other monetary market, the forex market has the biggest notional value of daily trading. This offers the highest level of liquidity, which suggests also large orders of money trades are easily filled effectively without any kind of huge price inconsistencies.

Unless significant events are expected, one can observe comparable rate patterns (of high, mid, or low volatility) throughout the non-stop trading.

Getting The Top 30 Forex Brokers To Work

Such a decentralized and (reasonably) deregulated market helps avoid any type of sudden shocks. Contrast that to equity markets, where a business can all of a sudden state a reward or record massive losses, resulting in significant rate changes. This low level of policy likewise assists keep prices reduced. Orders are directly positioned with the broker that executes them on their own.

The significant currencies frequently show high price swings. If professions are placed carefully, high volatility assists in substantial profit-making possibilities. There are 28 major money pairs involving eight significant currencies. Criteria for picking a pair can be convenient timing, volatility patterns, or financial developments. A foreign exchange trader who enjoys volatility can quickly change from one currency set to one more.

Top 30 Forex Brokers Things To Know Before You Buy

While trading on such high margins comes with its own threats, it additionally makes it simpler to get much better earnings possibility with limited funding.

As a result of the large dimension of the foreign exchange market, it is much less vulnerable to insider trading than some various other markets, specifically for major money pairs. Nevertheless, it is still occasionally subject to market manipulation. In essence, there are lots of benefits to forex trading as a career, but there are disadvantages.

4 Easy Facts About Top 30 Forex Brokers Explained

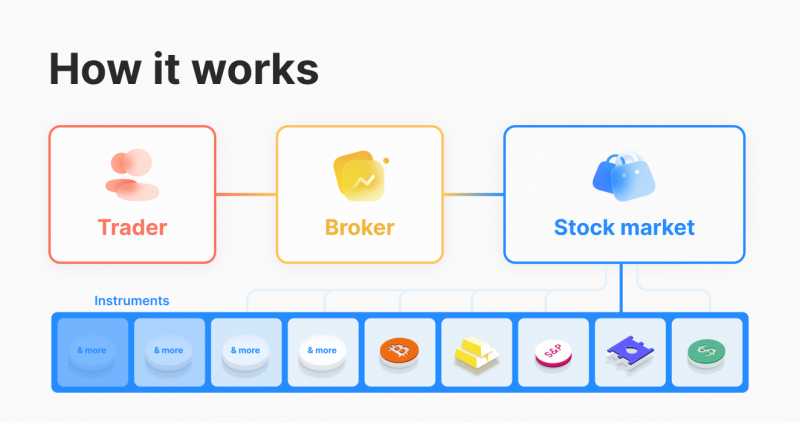

Being broker-driven means that the foreign exchange market may not be totally transparent. An investor may not have any kind of control over exactly how his profession order gets met, may not obtain the ideal cost, or might obtain restricted sights on trading quotes as provided just by his picked broker. A basic solution is to deal only with managed brokers who drop within the province of broker regulators.

Forex rates are affected by multiple elements, largely worldwide national politics or economics that can be challenging to examine information and attract reputable verdicts to trade on., which is the key reason for the high volatility in forex markets.

Not known Details About Top 30 Forex Brokers

Foreign exchange investors are entirely on their very own with little or no assistance. important site Disciplined and constant self-directed discovering is a have to throughout the trading job.